Best Personal Finance Software For 2024: Empower vs Mint vs Quicken & More

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Gone are the days of keeping receipts and Excel spreadsheets; this year, money management is easier, faster, and much more efficient than it used to be. Personal finance software can help with consolidating your finances, setting monthly budgets, and much more, but deciding which one is best for you can be a difficult and confusing task. When managing your money, whether you’re tracking investments, planning your family budget, or saving for retirement, it is essential to find the right tool for the right job.

| Portfolio Management | Home Finances | 3rd Place |

|---|---|---|

| Read Review | Read Review | Read Review |

| Visit Website | Visit Website | Visit Website |

Who Will Benefit From Using Personal Finance Software?

You do not have to be a finance expert to use personal finance software. It also doesn’t matter how much money you earn or how much you invest (or not), as most people would benefit from setting a budget or simply keeping track of their finances. We’ve researched the most popular solutions and selected our best personal finance software winners. We also share the pros and cons of the other players in the market so that you can make the best choice for you.

Jeff Butler is our financial guru, holding an undergraduate degree in Finance from Malone University. He has a diverse background in small business ownership, accounting, and property management. With his expertise in personal finance, Jeff consults on and reviews our investing and financial content, including this article.

Our Picks For Personal Finance Management Software

A recent survey by debt.com shows that budgeting is at an all-time high, with more than 8 out of 10 households maintaining a budget to help them balance spending and saving. Planning and following a budget is the first step in personal finance. These solutions can help you control your spending and build savings.

We have carefully reviewed and tested the services below, taking into consideration cost, usability, and special features. Here are our recommendations for the best way to manage your money via personal finance software.

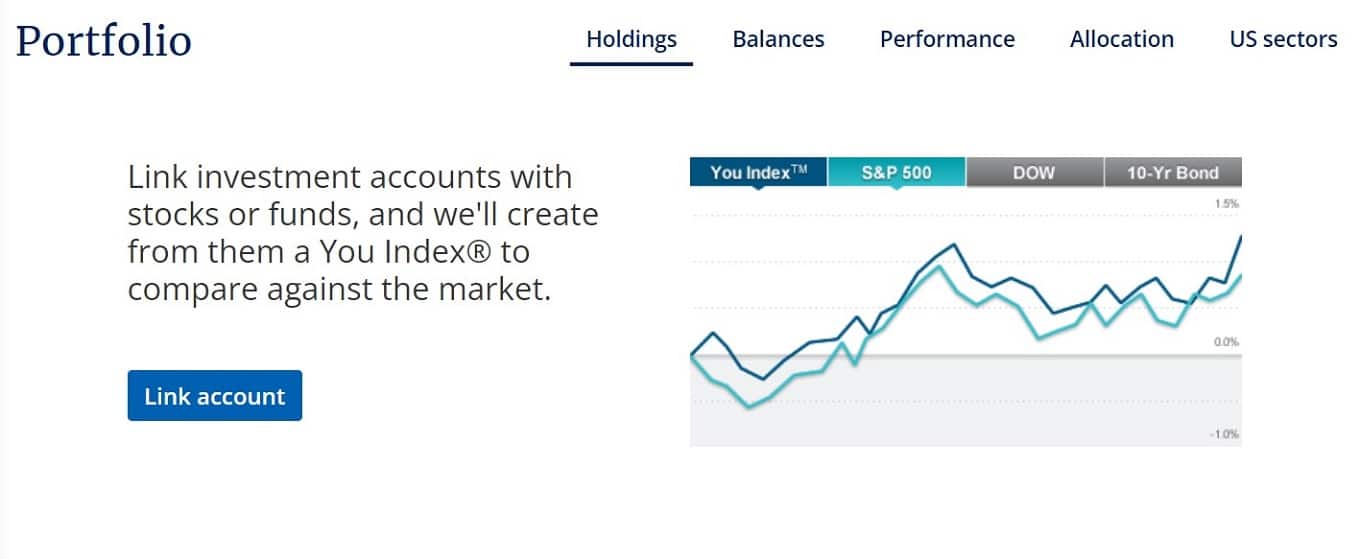

Best For Portfolio Management: Empower

Empower (formally Personal Capital) is one of our top personal finance software choices. It offers an easy-to-use personal dashboard to keep track of your expenditure and budgeting, as well as a personalized advisory service for your investment portfolios. There’s something for everyone with Empower.

The free service, the personal financial aggregator, is great, and we found it simple to use and very straightforward when linking accounts and setting budgets. However, what Empower really excels at is tracking every aspect of your investments, including balance and performance, and more.

| Pros | Cons |

|---|---|

|

|

Pricing

- Free personal financial aggregator

- Advisory service fee to manage your money, which is based on a percentage of assets managed through Personal Capital:

- First $1 million: 0.89%

- First $3 million: 0.79%

- Next $2 million: 0.69%

- Next $5 million: 0.59%

- Over $10 million: 0.49%

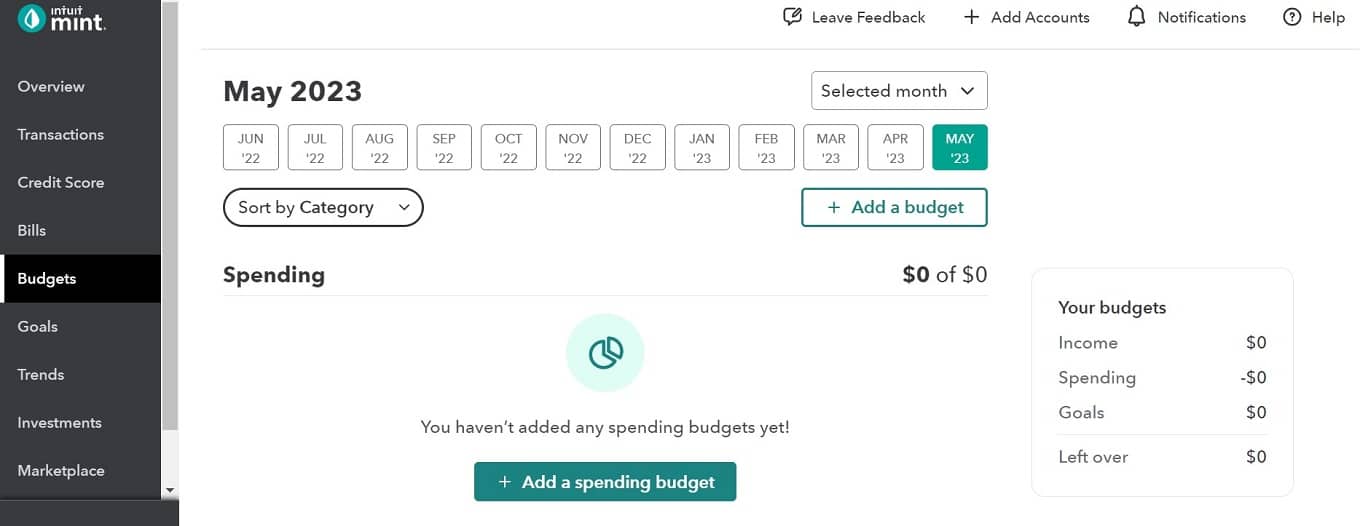

Best For Home Finances: Mint

From the maker of TurboTax and Quicken, Intuit acquired Mint.com back in 2009. Mint has tons of features, including creating a budget and paying bills. The software can connect to nearly every financial institution in the U.S. that is connected to the Internet.

Mint automatically updates and organizes your information into categories so you can see where your money is being spent. They send you alerts as well in case there are any unusual charges on your account. You can also get custom tips on how to cut costs and increase your savings.

I’ve used Mint for many years. I’ve yet to find a more straightforward solution to track all of my accounts in one place. I use it to get a quick look at my checking, savings, credit cards, brokerages, and retirement accounts. If I used the same bank for all of these accounts, I suppose I wouldn’t need Mint, but these accounts spread across multiple institutions. At the end of the month, it is helpful to get a snapshot of how I spent my money. – Jeff B.

Below is Mint’s budget page where you can add budgets into categories such as ‘grocery shopping’ or ‘entertainment’ etc.

| Pros | Cons |

|---|---|

|

|

Pricing

- Free

How Does Mint Work? (Video)

To see for yourself how Mint works, check out this short 1-minute video for an overview.

Best For Businesses: Quicken

Industry giant Quicken has long been considered one of the leading brands for all aspects of financial management, and it can be especially helpful to you if you run a small business.

Their personal finance software has gone through dozens of iterations and improvements over the years. Today it is a full-fledged, robust personal finance tool that’s easy to use with some useful features. Quicken’s Home and Business package helps with your tax planning, manages your expenses by separating them into categories, and can generate business reports. One drawback, however, is that it is only compatible with Windows, so if you are a Mac or Chromebook user, then you’ll need to consider other options.

Here is a short video on what you can expect from Quicken.

| Pros | Cons |

|---|---|

|

|

Pricing

- Simplifi by Quicken: $28.68 for the first year, $47.88 thereafter

- Quicken Deluxe: $35.88 for the first year, $59.88 thereafter

- Quicken Premier: $50.28 for the first year, $83.88 thereafter

- Quicken Home & Business: $71.88 for the first year, $119.88 thereafter

More Personal Finance Companies Reviewed (A-Z)

The race to the top of the personal financial software mountain is not only competitive, but it’s also very tight. All the home finance software we review below has its own unique list of pros and cons to help you decide for yourself which option best suits your individual needs.

AceMoney | Banktivity | Buxfer | GnuCash | Moneydance | MoneyStrands | MoneyWell | You Need A Budget (YNAB)

AceMoney Review

AceMoney is a paid personal finance solution that prides itself on an easy-to-use interface with a fully featured backend.

Users can manage many different accounts, track spending, record expenses, and bank online. It does not have an option to export data to tax programs, however.

| Pros | Cons |

|---|---|

|

|

Price

- Full Version – $44.95 (free lifetime upgrades)

Banktivity Review (Formerly iBank)

Banktivity (formerly iBank) is an Apple-only personal finance software with an intuitive user interface. Banktivity works with your iPad and iPhone as well, so you can access your information on the go, but you must pay for Banktivity on these devices.

A large portion of Banktivity users switched from Quicken, but many admit to regretting the decision.

| Pros | Cons |

|---|---|

|

|

Price

- Bronze Subscription – $49.99

- Silver Subscription – $69.99

- Gold Subscription – $99.99

Buxfer Review

Buxfer is a paid-for personal finance management software that offers easy online money management. Buxfer’s IOU function allows users to track bills and expenses among friends and families.

Transactions you make are automatically downloaded to your account, and you receive real-time alerts if you overspend. You can also plan ahead for big expenses like a wedding, vacation, car, or home.

| Pros | Cons |

|---|---|

|

|

Pricing

- Plus – $3.99 per month

- Pro – $4.99 per month

- Prime – $9.99 per month

GnuCash Review

GnuCash is an open-source personal finance service that is completely FREE. Designed to be easy to use, GnuCash has many powerful features. It performs like a checkbook register to enter and track different accounts.

GnuCash’s website could do with a little modernization, but the service itself is great for start-ups and small businesses. It offers personal finance management and has great professional accounting capabilities.

| Pros | Cons |

|---|---|

|

|

Price

- Free

Moneydance Review

Moneydance has built up a loyal following of users. One of the things that makes Moneydance shine is its cross-browser compatibility and the easy-to-view overall snapshot of your finances.

| Pros | Cons |

|---|---|

|

|

Pricing

- Subscribe Monthly – $9.00

- Annually – $90.00

Strands Review

Strands (formerly MoneyStrands) is money management software that makes it easy to get financially organized online by tracking spending, providing a real-time overview of finances, incorporating a great budgeting tool, and recommending savings tips.

| Pros | Cons |

|---|---|

|

|

Price

- Varies based on the solution required

MoneyWell Review

MoneyWell is an Apple-only (Mac and iOS) personal finance solution. Money Well’s strong suit is that it was designed as a budgeting system to help users eliminate debt and grow wealth.

| Pros | Cons |

|---|---|

|

|

Pricing

- Full Version – $49.99

- MoneyWell for Ipad – Free

- MoneyWell Express (for iPhone) – Free

You Need a Budget (YNAB) Review

You Need a Budget (YNAB) is designed to give you total control of your money by making you account for all cash inflows and outflows. Just using YNAB will make you a more responsible financial manager.

It has a unique way of giving every dollar a ‘job,’ saving for a rainy day, learning to roll with the punches, and quitting the unpredictable paycheck-to-paycheck lifestyle.

| Pros | Cons |

|---|---|

|

|

Pricing

- 34-Day Full-Featured Demo – Free

- Annual Plan – $8.25 p/m ($99 annually)

- Monthly Plan – $14.99

Which Personal Finance Solution Is Right For You?

After looking through the pros and cons of our personal finance software reviews as well as the basic features of some of the more popular personal finance solutions, you should have an idea of just what it is that you are looking for.

- The first step is to prioritize which features are most important to you and which features you can live without.

- Then, if one of the services meets your needs and is free, then go for it! If not, then pricing will come into consideration.

- Finally, when you have narrowed down your selection to a few companies, it is important to look at reviews of other users in addition to finding answers to any questions you may have.

Research is key to finding a personal finance solution that works best for you because once you commit to a product, it can be very time-consuming as well as difficult to transfer account information from one personal finance solution to another. Make the right decision now, and you will be amazed by how much you will learn and grow in your ability to manage and control your personal budget and wealth.

Who’s Got The Best Credit Card?

Looking for more ways to stay on top of your finances? Check out these peer-to-peer lending websites for some affordable loan solutions, find the best credit card, and learn how you can apply for a mortgage online.

Which provider are you leaning towards? Let us know in the comments!