Best Peer-To-Peer Lending Sites: Upstart vs Sofi vs Lending Club vs Prosper vs Funding Circle & More

When you purchase through links on our site, we may earn a commission. Here’s how it works.

| 1st |

|

| 2nd |

|

| 3rd |

|

| Compare All Products | |

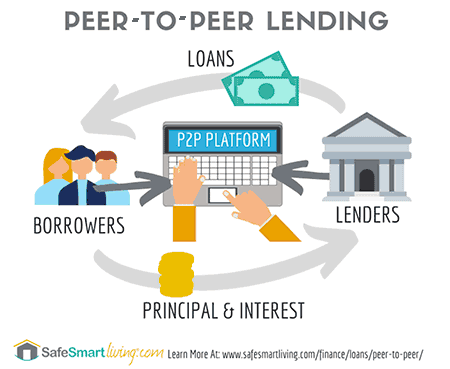

Has a bank turned you down for the loan you need? Or are you worried your credit score won’t cut it? Whether you need to consolidate debt, boost your small business, or want to make some home improvements, you’re still in luck. Peer-to-peer lending sites could be the answer to your financial needs. In many cases, peer-to-peer (P2P) loans are an excellent alternative to traditional loans.

Article Overview

- How Does A Peer-To-Peer Loan Work?

- Different Types of Loans Compared

- Best Companies To Loan From

- Comparison of Companies (Table)

- Why Invest? (Video)

- Are Peer To Peer Loans Risky?

- Can You Trust These Companies?

Jeff Butler is our financial guru, holding an undergraduate degree in Finance from Malone University. He has a diverse background in small business ownership, accounting, and property management. With his expertise in personal finance, Jeff consults on and reviews our investing and financial content, including this article.

How Do Peer-To-Peer Lending Sites Differ From Traditional Loans?

The most significant difference is that everyday investors back peer-to-peer (P2P) lending sites rather than financial institutions. Many P2P lenders also grant loans to people who might not qualify for a traditional bank loan (i.e., if your credit score is lower or your small business isn’t showing substantial profits yet). Also, P2P lending sites are known for quick loan approval and disbursement of funds compared to traditional banks.

The most significant difference is that everyday investors back peer-to-peer (P2P) lending sites rather than financial institutions. Many P2P lenders also grant loans to people who might not qualify for a traditional bank loan (i.e., if your credit score is lower or your small business isn’t showing substantial profits yet). Also, P2P lending sites are known for quick loan approval and disbursement of funds compared to traditional banks.

What Can I Expect As A Borrower?

First, it’s essential to know that your state may not permit you to borrow or invest with certain P2P sites. P2P lenders in the United States are required to register with the federal Securities and Exchange Commission (SEC), but each state has different regulations regarding securities. Check each P2P lending site to see if your state allows you to invest or borrow money online with that company.

First, it’s essential to know that your state may not permit you to borrow or invest with certain P2P sites. P2P lenders in the United States are required to register with the federal Securities and Exchange Commission (SEC), but each state has different regulations regarding securities. Check each P2P lending site to see if your state allows you to invest or borrow money online with that company.

Most peer-to-peer lending sites allow you to check your interest rate or apply for pre-approval (often called a soft inquiry). This soft inquiry won’t negatively impact your credit score; applications for traditional loans usually affect your credit report. Similar to typical loans, P2P sites base your interest rate on your credit score, your credit history, your loan amount, and terms (the period you’ve chosen to repay your loan).

Once you’re approved, P2P lenders assign your loan request a grade based on your overall risk factor as a borrower. These grades give investors the information they need to decide the level of risk they want to take with their investment (the greater the risk, the higher the investment returns).

What Kind Of Loan Can I Get With A P2P Lender?

Want to buy a new car or house? Need to pay off medical expenses or high-interest credit cards? Does your small business need a boost? Debt consolidation accounts for more than half of all peer-to-peer loans, but you have a ton of options depending on the lending site. Most P2P sites offer personal and student loans. Others focus on peer to peer business lending. Our reviews below will give you a better idea of what type of loan you can get with each company.

Best Peer-to-Peer Lending Sites

Below are our top three picks for the best P2P lending sites with peer to peer lending pros and cons for each, followed by two easy to use comparison tables and then several other lending companies that didn’t make our top three but are worth consideration. We’ve given you information to help you decide which website is best for you, whether you’re a borrower or an investor.

Winner: Lending Club Review

Lending Club, the clear leader in this industry, wins our number one spot for the best peer-to-peer lending site. Lending Club has built a solid reputation since becoming one of the first peer-to-peer lending sites — they’ve granted more than $20 billion in loans since 2007, and they continue to have a loyal base of investors.

They also offer competitive APRs, flexible terms, excellent customer service, good investment options, and more. You can obtain small business loans up to $300,000 or get a personal loan up to $40,000 for a variety of reasons. Lending Club has competition, but their reputation is hard to beat.

Pros |

Cons |

|

|

Runner-Up: Upstart Review

Upstart, our number two pick, is a relative newcomer among peer-to-peer lending sites (launched in 2012 by “ex-Googlers”). But they’ve made a reputation for themselves with more than $300 million in loans and double-digit month-over-month growth.

Geared more toward young professionals (20’s and 30’s), Upstart says they place more emphasis on the “potential” of borrowers rather than static eligibility requirements.

Their approval process considers employment history, schools you attended, and academic performance, among other factors. Upstart is a great option for people who haven’t had time to build up a long credit history.

Pros |

Cons |

|

|

3rd Place: Prosper Review

Prosper, the first company to offer online peer-to-peer person loans comes in third place in our best P2P lending site reviews. Prosper and our number one pick, Lending Club, are the two major players in the industry.

What keeps Prosper out of our top two spots? Prosper only offers personal and personal small business loans at a cap of $35,000, and their eligibility requirements are more strict than Upstart.

That’s good news for potential investors. Prosper has a long history of investor backing, and they’re careful about who they approve for loans.

Pros |

Cons |

|

|

P2P Lenders Compared Side-By-Side

We’ve compiled side-by-side comparison tables to help you easily see the differences between our best peer-to-peer lending sites. Our first comparison table is for borrowers, and the second is for investors.

For Borrowers

| Winner: Lending Club | 2nd Place: Upstart | 3rd Place: Prosper | Funding Circle | Peerform | SoFi | |

|---|---|---|---|---|---|---|

| Winner: Lending Club | 2nd Place: Upstart | 3rd Place: Prosper | Funding Circle | Peerform | SoFi | |

| Personal Loans | ||||||

| Small Business Loans | As a personal loan | As a personal loan | ||||

| Minimum Loan Amount | $1,000 Personal; $5,000 Small Business | $1,000 | $2,000 | $25,000 | $1,000 | $5,000 |

| Maximum Loan Amount | $40,000 Personal; $500,000 Small Business | $50,000 | $35,000 | $500,000 | $25,000 | $100,000 |

| Minimum Credit Score | Unlisted | 620 | 640 | Unlisted | 600 | Unlisted |

| Check Your Rate | Must apply | |||||

| Lowest Interest Rate | 5.32% | 4% | 3% | 5.49% | 6.44% | Unlisted |

| Lowest APR Rate | 5.99% | 4.66% | 5.99% | 5.49% (interest rate) | 7.12% | 5.95% |

| Highest APR Rate | 34.34% | 29.99% | 36% | 27.79% (interest rate) | 29.99% | 12.99% |

| Origination Fee | 1-6% | 1-6% | 1-5% | .99-5.99% | 1-5% | None |

| Approval Time | 7 Days Average | As Soon as 1 Day | 7 Days Average | Up to 72 Hours | 1-14 Days | Several Business Days |

| Loan Terms | 24, 36 or 60 months personal; 1-5 years small business | 36 or 60 months | 36 or 60 months | 12, 24, 36, 48 or 60 months | 36 months | 36, 60, or 84 months |

| Late Fee | $15 or 5% of missed payment amount (whichever is greater) | $15 or 5% of missed payment amount (whichever is greater) | $15 | 10% of missed payment amount | $15 or 5% of missed payment amount (whichever is greater) | $5 or 4% of missed payment amount (whichever is less) |

| Grace Period | 15 days | 10 days | 15 days | Unlisted | 15 days | 15 days |

| Failed Payment Fee | $15 | $15 | Unlisted | $35 | $15 | Unlisted |

| Check Processing Fee | $7 | Unlisted | $15 | Unlisted | ||

| Dedicated Account Advisor | $15 or 5% of missed payment amount (whichever is greater) | $15 or 5% of missed payment amount (whichever is greater) | ||||

| Customer Service Hours | Mon-Sat: 6am-5pm PST | Mon-Sun: 6am-5pm PST | M-F: 8am-9pm; Sat. 9am-5:30pm EST | M-F 8am-8pm PST | M-F 9am-6pm EST | M-Th 7am-8pm; F-Sun 7am-4pm PST |

For Investors

| Winner: Lending Club | 2nd Place: Upstart | 3rd Place: Prosper | Funding Circle | Peerform | SoFi | |

|---|---|---|---|---|---|---|

| Minimum to Invest | $25 | $100 | $25 | $500 | Unlisted | Unlisted |

| Manual Investing | Unlisted | |||||

| Automated Investing | Unlisted | |||||

| 401K Rollover | Unlisted | Unlisted | ||||

| IRA | Unlisted | Unlisted | ||||

| Risk Grading | ||||||

| Return Range | 5%-8% | Unlisted | 4.32%-11.25% | Unlisted | Unlisted | Unlisted |

| Monthly Service Fee | 1% | Unlisted | 1% | .083% | Unlisted | Unlisted |

| Reinvest Option | Unlisted | Unlisted | ||||

| Customer Support Hours | M-F: 7am-5pm PST | M-F: 6am-5pm PST | M-F: 11am-8pm EST | M-F: 8am-6pm PST | M-F: 9am-6pm EST | M-Th: 7am-8pm; F-Sun: 7am-4pm PST |

What About Funding Circle, Peerform, and SoFi?

Don’t rule these companies out, they may be a good fit for you based on your needs. Click on a link below to jump straight to the peer-to-peer lending review you’re interested in, or just keep scrolling.

Funding Circle | Peerform | SoFi

Funding Circle Review

Funding Circle is a global leader in peer-to-peer lending, but you won’t find personal loans here. They focus entirely on small business P2P loans — and they do it well. Since 2010, Funding Circle has lent more than $2 billion to over 5,000 businesses. What’s their secret?

Funding Circle is a global leader in peer-to-peer lending, but you won’t find personal loans here. They focus entirely on small business P2P loans — and they do it well. Since 2010, Funding Circle has lent more than $2 billion to over 5,000 businesses. What’s their secret?

All of Funding Circle’s loans are secured. In early 2015, Victory Park Capital-backed Funding Circle’s loans with a hefty $420 million in capital. But Funding Circle remains a powerhouse for investors wanting higher returns with online person-to-person loans. They’re not the go-to place for startups, however.

To qualify, you must submit two years of business tax returns, among other criteria. Funding Circle no longer has a minimum revenue requirement, and you no longer have to show a profit in the last two years.

Pros |

Cons |

|

|

Peerform Review

Peerform hasn’t been in the P2P lending industry as long as Lending Club or Prosper, but a six-year track record is impressive in the ever-changing world of web-based companies — and especially regarding P2P online loans.

Peerform hasn’t been in the P2P lending industry as long as Lending Club or Prosper, but a six-year track record is impressive in the ever-changing world of web-based companies — and especially regarding P2P online loans.

Peerform’s minimum credit score is 600, lower than most peer-to-peer lending for bad credit. But, you’ll pay higher APR rates with Peerform. They offer personal loans for debt consolidation, installation loans, wedding loans, home improvement, medical expenses, moving and relocation, and car financing (no small business loans).

On the investment side, Peerform mainly focuses on institutional investors rather than individuals.

Pros |

Cons |

|

|

SoFi Review

Social Finance, Inc. (SoFi) launched in 2011 as a peer-to-peer lending site for student loan refinancing, but in 2015 they expanded into personal loans. They also offer MBA loans, parent loans, and mortgage loans. SoFi has impressively low APR rates for student loan refinancing — you can even consolidate federal and private loans.

Social Finance, Inc. (SoFi) launched in 2011 as a peer-to-peer lending site for student loan refinancing, but in 2015 they expanded into personal loans. They also offer MBA loans, parent loans, and mortgage loans. SoFi has impressively low APR rates for student loan refinancing — you can even consolidate federal and private loans.

Their rates for personal loans are competitive, and with each type of loan, you can choose a fixed or variable rate. In 2014, SoFi got a financial boost with $200 million in Series D funding from Third Point Ventures, but they still welcome everyday investors. There’s not much on their site about the investment side, so you’ll have to contact them to learn more.

Pros |

Cons |

|

|

Why Invest With Online Lending Companies?

Investing with a peer-to-peer lending company has a lot of benefits. First, average returns are higher compared to similar investment opportunities. And you’re in the driver’s seat — you choose who you want to fund based on the risk and potential yield. Many P2P lending sites allow you to lend money online for as little as $25!

Not a fan of big financial institutions? P2P sites eliminate the impersonal “big bank” approach to lending. Don’t forget, these are everyday borrowers who have genuine needs and heartfelt personal stories. You have the chance to make a real difference in someone’s life. The major drawback for potential investors? Most person to person lending sites require you to be an accredited investor, which may be a roadblock for some people (essentially this is individuals who make an annual income of $200,000 or greater, or have a net worth of at least $1,000,000).

Video: Money Talks

You’ll want to watch this Money Talks News video if you’re considering investing in P2P social lending sites.

Are P2P Loans Risky Investments?

If you are interested in P2P investing, you should be somewhat risk-tolerant. The biggest risk is a financial loss. Most peer to peer loans are unsecured — if a borrower fails to pay, you lose some or all of your investment. Diversification with peer-to-peer loans is crucial, and most P2P sites allow you to do this pretty easily. That’s where “notes” and the risk grading system come in.

Individual investors have the ability to fund small portions of loans, called notes. As an investor, you can typically select many different notes to fund and the amount you’d like to invest for each note. As we mentioned above, a P2P site assigns each borrower a letter grade based on the borrower’s riskiness. So you can invest in a diversity of risk grades to minimize your risk of loss.

There’s always the risk of a peer-to-peer lending site going under. P2P notes typically aren’t guaranteed by a government body or other institution. That’s why it’s important to choose one of the best peer-to-peer lending sites.

Can I Trust These Sites?

Peer-to-peer lending is an industry that’s in constant flux. But for now, we believe you can trust our best peer-to-peer choices. Why? The traditional peer-to-peer lending model hasn’t held up over the last few years, and most peer to peer lending platforms have had to turn to investment brokers to provide the funding for many of their loans. Their financial backing is more solid.

For borrowers looking for an alternative to big banks, P2P lending is still a much better choice. For investors, there’s still a large market of qualified borrowers.

Now that you’ve read our peer to peer lending reviews we encourage you to learn more about other lending opportunities, including Lending Tree, online mortgage lending, and credit cards as ways to pay for needed or unexpected financial costs.