How To Choose The Best Life Insurance Policy

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Life insurance isn’t the most exciting topic, but it’s one that we all are faced with at some point in our lives as to whether or not we need it. There’s no need to spend days trying to comprehend the ins and outs of life insurance. We make life insurance easier to understand by explaining the different types, helping you determine how much you need and suggesting ways to save money on your policy.

Life insurance isn’t the most exciting topic, but it’s one that we all are faced with at some point in our lives as to whether or not we need it. There’s no need to spend days trying to comprehend the ins and outs of life insurance. We make life insurance easier to understand by explaining the different types, helping you determine how much you need and suggesting ways to save money on your policy.

Article Overview

What Are The Different Types Of Life Insurance?

If you’re new to life insurance, you may find yourself confused with term and permanent life insurance. These are the two broad types of life insurance and depending on your financial plans, and you may opt for one over the other.

Term life insurance is generally less expensive than permanent life insurance, but it is only active during a set time (30 years is typically the longest). So, if a death occurs during the policy term, it will pay out. However, if a death occurs after the policy term has ended, no benefits will be dispersed.

Permanent life insurance is a policy that lasts the entire life of the person it insures. So, no matter when the death occurs, as long as the policy remains in force and doesn’t lapse due to premium non-payment, the death benefit will be paid to the beneficiaries. There are two major types of permanent life insurance, whole life and universal life.

Our brief explanation of term and permanent life insurance is just the tip of the iceberg. There is much more to learn about these types of life insurance, and we urge you to learn about them thoroughly before you purchase anything. Read our types of life insurance guide to ensure you buy the right policy to support the needs of your loved ones when you pass. Our article also includes pros and cons of choosing the different types of policies.

How Much Life Insurance Do I Need?

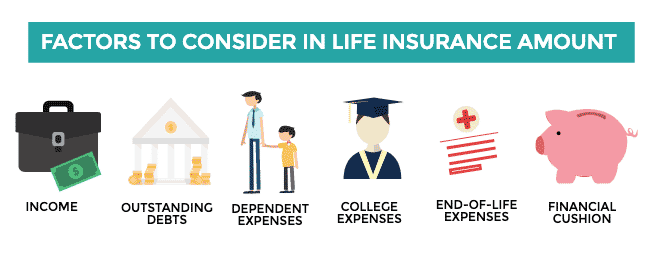

The million dollar question. There are many things you’ll want to consider when deciding on an amount of life insurance including:

- Income

- Outstanding debts

- Dependent expenses

- College expenses

- End-of-life expenses

- Financial cushion

You’ll also want to factor in your assets (e.g., bank accounts, investment accounts, etc.). Consider the lifestyle you want your loved ones to have after you pass. Do you want the life insurance policy to replace your salary? Do you want it to allow your spouse to stop working? Finally, create a budget to know exactly what you can afford to pay each month.

We take you step-by-step through the process in our how much life insurance do I need and why guide.

How To Get A Lower Life Insurance Rate

Many factors affect your life insurance rate. Some you can’t change like your family medical history and age. Others you can change like your overall health and lifestyle. The healthier you are, the lower your life insurance premiums will be.

There are also other ways of getting a less expensive policy by choosing one type of life insurance over the other or simply shopping around for different companies. We’ve got lots of tips to help you find the most affordable life insurance policy.