How Does Universal Life Insurance Work And Is It Worth It?

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Article Overview

- What Is Universal Life Insurance?

- How Does It Work?

- Pros & Cons

- Types Of Universal Life Insurance

- How Much Does It Cost?

- Is It Worth It?

What Is Universal Life Insurance?

Permanent life insurance covers you for your entire lifetime as long as you pay the minimum premium to keep the policy active. In contrast, term life insurance only provides coverage for a set period, such as 10 or 20 years. Some permanent life insurance also allows you to accumulate cash value (savings) over time that you can borrow against tax-deferred. Term life doesn’t offer this feature.

Understanding Cash Value

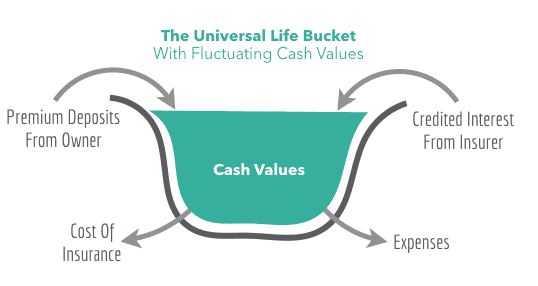

All types of permanent life insurance have a cash value component. Every time you make a premium payment, part of the money goes toward the:

- Cost of insurance — the amount needed to provide the death benefit

- Fees — the cost for the insurance company to manage your policy

- Cash value — a savings component within the life insurance policy

The portion of your premium payment that goes toward the cash value component sits in an account, which grows over time (and that growth is tax-deferred). With a universal life policy, the cash value earns interest based on the current market or minimum interest rate. As the cash value grows, you may access a portion of the cash value as a policy loan; however, the death benefit will be reduced by any current outstanding loan amount.

Also, if you decide to surrender your insurance coverage early, you can receive the policy’s cash value (minus any surrender charges). However, if you keep the insurance in-force and do not surrender the policy, keep in mind that upon your death, your beneficiaries will only receive the death benefit, not the cash value of your policy.

How Does Universal Life Insurance Work?

The most significant advantage of universal life insurance is that it delivers the greatest flexibility for policyholders to adapt their policy to meet changing financial needs across time.

With universal life, you can pay your premiums in varying amounts and at any time (within some limitations). And you can also reduce your death benefit to lower your premiums if you find your situation has changed. Certain policy riders (or add-ons) will even allow you to increase the death benefit. Note: You must select these riders at the initial purchase of the policy.

The challenge of universal life insurance is that it requires you, as the policyholder, to assume a higher degree of risk and responsibility for maintaining your policy than many other types of life insurance like whole life. It’s up to you to ensure that there is no lapse in coverage due to unpaid premiums and to make sure that you don’t exhaust your cash value. If your cash value drops to zero, your policy could lapse.

Learn About The Differences Between Universal And Whole Life Insurance

Types Of Universal Life Insurance

There are several types of universal life insurance available for individuals. But some of these may not be available with your employer’s group universal life insurance option.

Indexed Universal Life Insurance

If the market’s doing well, your cash value will rise — but not necessarily as much as if you had your money invested directly in the index. Why? Many policies have earnings rate caps. So, if the S&P 500, for example, earns 11% but your policy’s rate cap is 7%, you won’t benefit from the maximum possible earnings (you’ll be capped at 7%, which is the maximum participation in this example). Another downside is that the market could drop, preventing your cash value from growing (but most policies have a minimum guaranteed rate to protect your cash value).

Variable Universal Life Insurance

Some policies restrict the number of transfers into and out of the funds, so if your sub-accounts aren’t performing well, you may end up having to absorb those losses. This could result in higher premium payments to cover your cash value.

Guaranteed Universal Life Insurance

With guaranteed universal life, your premiums and interest rate are fixed for the life of the policy. These policies also have a no-lapse guarantee as long as you pay your premiums (even if the cash value drops to zero). But this also means that the cash value is always extremely minimal. Still, this could be your best option if your primary concern is having a guaranteed death benefit for your survivors.

How Much Does Universal Life Insurance Cost?

Universal life insurance coverage can range from $25,000 to $1 million or more. The higher the coverage, the higher the premium payments. Premium costs vary widely based on the amount of coverage you choose, your age, whether you’re a smoker and any health conditions you have.

Is Universal Life Insurance Worth It?

Universal life can be an excellent option for people who want life insurance but don’t want fixed premium payments for the rest of their lives. It’s by far the most flexible type of life insurance you can find. However, managing universal life policies can be complicated, especially if you’re not financially savvy.

Be sure to read our guide to all of your life insurance options, where we cover additional options like whole life, term life and variable life insurance. We also give you tips on how to determine the ideal amount of life insurance you’ll need and how to find life insurance that meets your budget.