How Does A 529 Savings Plan Work? Save For College The Smart Way

When you purchase through links on our site, we may earn a commission. Here’s how it works.

With college costs continuing to soar, you may wonder how in the world you’ll ever be able to pay for your kids’ education. Of course, the sooner you start saving, the better — especially with a 529 plan. These plans are specifically designed to make saving for future education costs as easy as possible. They also carry some attractive benefits (tax advantages!) compared to other types of investment savings plans.

And in 2024, a previous barrier that I found too restrictive to create 529 plans for my two children was lifted. You can now roll over unused 529 savings into a Roth IRA account, making a 529 plan more enticing than ever.

But, backing up a bit, how does a 529 plan work? Are there contribution minimums? And what can you use funds for? I’ll answer these questions and many more to help you decide if a 529 plan is the best fit for your financial planning needs.

What Is A 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to encourage savings for future educational costs. These plans, legally called qualified tuition programs (QTPs), are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code.

How Does A 529 Plan Work?

Originally designed to cover post-secondary education costs, Section 529 now also covers K-12 education, apprenticeship programs, and even student loan payments. There are two types of 529 plans: education savings plans and prepaid tuition plans. Education and college savings plans are far more popular than prepaid tuition plans and offer the best flexibility for institutional options and covered expenses.

Education Savings Plans

These plans allow you to open an investment account to save for a beneficiary’s future qualified higher education expenses, including tuition, mandatory fees, room and board, and more. Typically, you can use the savings at any college or university (in some cases, even non-U.S. colleges and universities).

You can also use these plans to pay up to $10,000 per year per beneficiary for tuition at any public, private, or religious K-12 school. All education savings plans are sponsored by state governments, but only a few have residency requirements for the saver and/or beneficiary.

Prepaid Tuition Plans

While not as popular as 529 savings plans, prepaid tuition plans could be a good option if you’re worried about continually rising tuition costs since they allow you to lock in current tuition rates for future education. The account holder can purchase units or credits at participating colleges and universities (mostly public and in-state) for future tuition and mandatory fees.

However, prepaid tuition plans can’t be used to pay for future room and board expenses, and they don’t allow you to prepay for elementary and secondary school tuition. Currently, fewer than 10 states sponsor prepaid tuition plans, and most have residency requirements for the saver and/or beneficiary. Some also have limited enrollment periods during the year.

Why Start Saving Now?

In the U.S., the costs of college continue to rise at an alarming rate. In fact, it has nearly tripled since the early 1980s. For example, my freshman year tuition as an in-state college student in 1987-88 was about $5,400. Fast forward to 2023-24, and annual tuition is now over $13,500 at the same university. Inflation and diminishing government assistance are forcing higher education institutions to raise tuition, room and board, and other fees.

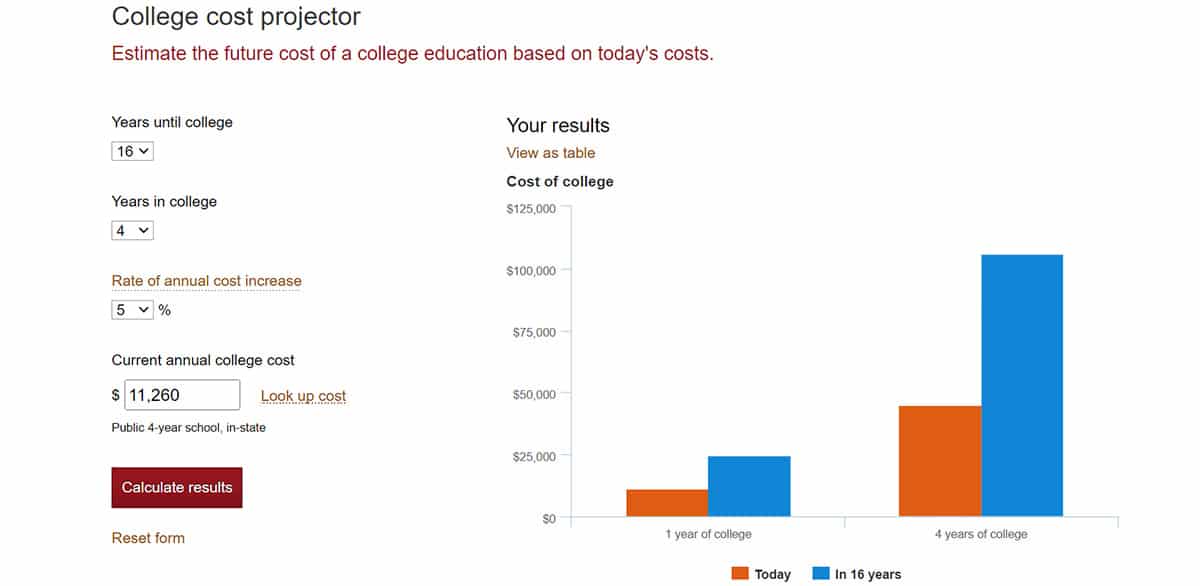

To help you understand the importance of saving as early as possible, I used Vanguard’s College Cost Projector, which incorporates data on college costs from the College Board. Based on today’s average college costs and a 5% annual rate increase, sending your child to a college will cost the following 16 years from now.

Total Average Tuition & Fees To Get A College Degree

| College Type | 2024 | 2040 |

|---|---|---|

| Public 2-year | $7,980 | $17,855 |

| Public 4-year in-state | $45,040 | $105,939 |

| Public 4-year out-of-state | $116,600 | $274,257 |

| Private 4-year | $166,160 | $390,828 |

Top 5 Benefits Of A 529 Plan

For most people, a 529 plan is the best way to save for the high costs of college in the future. The following benefits apply to the 529 education and college savings plan.

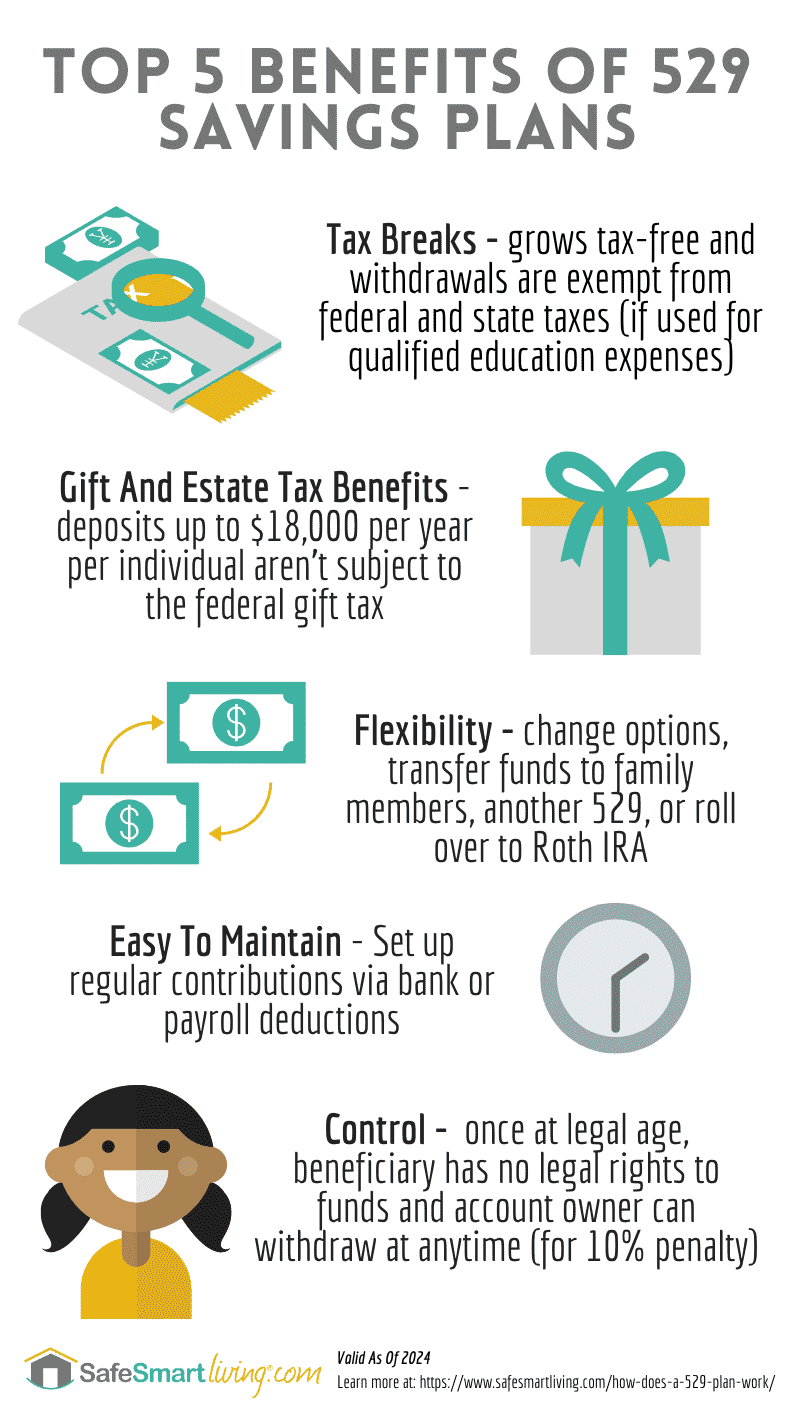

1. Tax Advantages

With 529 plans, your savings grow tax-free, and your withdrawals are exempt from federal and state taxes as long as you use them for qualified education expenses. Although contributions aren’t deductible on your federal taxes, over 30 states currently offer a full or partial tax deduction or credit for 529 plan contributions. If your state offers tax benefits, it probably makes the most sense to go with your state’s plan. Otherwise, you can choose any other state’s plan.

2. Annual Gift Tax Exclusion & Estate Tax Benefits

As of the 2024 tax year, contributions up to $18,000 per individual, per beneficiary qualify for the annual gift tax exclusion. You can also contribute up to $90,000 per individual per beneficiary in a single year without eating into your lifetime gift tax exclusion (essentially, you’re treating your contribution as if it was made over a five-year period).

3. Flexibility

Once you open a 529 account, you have several flexible options, including the ability to:

- Change your 529 plan investment options twice per calendar year

- Transfer the plan to another family member (children, siblings, nieces, nephews, first cousins, etc.)

- Transfer your funds to another 529 plan once per year

- Move up to $35,000 of unspent funds into a Roth IRA account tax-free if your 529 account is more than 15 years old

4. Easy To Maintain

If you’re not into investing details or just want a simple, hands-off way to save for education expenses, 529 plans are very maintenance-free. You can set up regular contributions via your bank account or through payroll deduction plans. The account’s ongoing investment management is handled either by an outside investment company the state hires or by the state treasurer’s office.

5. You’re In Control Of The Funds

In most cases, the account’s named beneficiary has no legal rights to the funds in a 529 account. For example, when a child reaches legal age, he or she can’t take over the assets, so you know the funds will be used for educational purposes.

As a 529 account owner, you can also withdraw funds for any reason at any time in case you run into financial difficulty. But keep in mind that you will incur a 529 withdrawal penalty in the form of income tax and a 10% penalty on the earnings portion of the account.

Our Personal Experience With 529 Plans

I’ve set up 529 plans for my children. I value the 529’s flexibility, covering a broad range of educational expenses beyond tuition. I also appreciate the tax benefits that come with contributing. Should the need arise, the ability to roll unused funds into a Roth IRA is reassuring, as I know the funds will not go to waste. Also, some family members have begun contributing to them on special occasions like birthdays, offering an alternative to toys and other unnecessary things.

– Jeff Butler, Finance Major, Analytics & SEO at Safe Smart Living

Who Can Open A 529 Plan?

There are no income restrictions to open an account, and states have no or quite low minimum contribution requirements (e.g., $25). With the exception of Wyoming, all states and the District of Columbia sponsor at least one type of 529 plan. With education savings plans, you can invest in almost any state 529 plan, not just your own state’s plan.

While most people open an account for their children or grandchildren, you can also open an account for other family members or someone you’re not related to. To open a 529 plan account, you must:

- Be a U.S. resident with a legal mailing address

- Be age 18 or over

- Have a social security number or tax ID (EIN)

What Can I Use A 529 Savings Plan For?

Here’s a list of the 529 eligible expenses as well as those that don’t qualify, as defined by the IRS. As I shared above, if you use 529 funds for unqualified expenses, you’ll be subject to income tax and a 10% penalty. Note: the prepaid tuition plans only cover tuition and mandatory fees.

529 Qualified Expenses

A 529 plan’s qualified education expenses include:

- Full tuition for undergraduate or graduate school

- Mandatory fees

- Room and board (must be enrolled at least half-time)

- Books and supplies

- Computers, related equipment, and internet access

- K-12 tuition up to $10,000 per year

- Student loan payments (up to $10,000 lifetime)

- Registered apprenticeship program fees

What Doesn’t Qualify?

- Transportation and travel costs to and from college

- Health insurance

- College application and testing fees

- Extracurricular activity fees

529 Plan Contribution Limits

Currently, you have no limits on how much you can contribute to a 529 account each year, but keep in mind that an annual contribution over $18,000 could be subject to gift taxes. States do cap how much you can contribute in total to an account. These aggregate contribution limits currently range from $235,000 to $550,000. Each state determines this limit based on the cost of attending an expensive post-graduate institution within the state.

How Does A 529 Plan Affect Financial Aid?

The impact of a 529 plan on financial aid eligibility is a common concern for many parents. A 529 plan can affect financial aid, but the impact is usually minimal. The effect also depends on who owns the account and the type of aid you’re applying for — 529 plans typically don’t affect merit-based aid (e.g., academic or athletic scholarships).

With federal need-based student financial aid, colleges require students to complete the Free Application for Federal Student Aid (FAFSA). Colleges use information from the FAFSA to measure a student’s Student Aid Index (SAI). This SAI determines how much federal aid a student qualifies for. Part of the FAFSA involves declaring assets, and 529 plans count as assets — depending on who owns the account.

- A 529 account owned by a dependent student or a dependent student’s custodial parent is reported as a parent asset on the FAFSA. A maximum of 5.64% of parental assets are factored into the SAI.

- A 529 account owned by an independent student is reported as a student asset on the FAFSA. Student assets are counted at 20%, not nearly as favorable as parental assets.

- 529 accounts owned by grandparents or others are not counted as an asset on the FAFSA.

Tips On Setting Up A 529 Plan (Savings)

Your first step is to find a 529 savings plan that best meets your investment goals. In some cases, your state’s plan may be your ideal option, but it’s wise to compare it to other state plans. Many states offer a tax deduction or tax credit for contributions to a 529 plan in any state.

Each state’s plan(s) differ in the types of investments they offer (i.e. the diversification of stocks, bonds, mutual funds, etc.), how the plans are managed, the overall performance of their plan’s offerings, returns, fees, and more. You’ll also want to consider each plan’s fees and expenses you’ll incur. You may ultimately find a better investment option going with another state’s plan.

Once you choose a plan, it’s fairly easy to open an account online. You can choose how you want your contributions invested, much like other types of investment accounts. You can do all of the legwork yourself or use a financial advisor to assist you in the process.

Our Personal Experience With Setting Up A 529 College Savings Plan

Before getting engaged, my husband and I made a conscious decision to have in-depth discussions about our finances and future goals. We knew disagreements over finances are among the most common reasons for marital conflicts. Thus, we interviewed multiple financial advisors to find the proper professional to assist us with long-term savings and investment opportunities.

With our advisor’s help, we set up 529 plans for our children’s future right after birth, taking advantage of the state tax benefits. Our automatic contributions ensure that we never forget to save for their future.

We review all of our investment accounts and beneficiaries annually to ensure that we remain on track and that our financial goals are aligned with our Will. It is essential to remember that beneficiaries listed in financial accounts, including bank accounts, IRAs, and 529s, generally override the Will. This is a common misconception that could cause significant problems if not addressed.

Be aware that 529 plans can be transferred to other family members. For example, if you have a 529 plan for your child who receives a full scholarship to college, you can transfer the plan to another child. By keeping your beneficiaries up-to-date, you can avoid any unnecessary complications. This becomes more complicated with other finance accounts, but it is also a good practice for 529 plans.

– Kimberly Alt, Investment Savvy Mom & Safe Smart Living Researcher

529 Savings Plans vs Other Education Savings Options

If you’re shopping around for the ideal education savings plan, you may have run into other types of plans. Here’s how the 529 plan compares to other popular options.

Coverdell ESA vs 529

The Coverdell Education Savings Account (ESA) is the other main option in the U.S. designed specifically for education savings. Here are some key similarities and differences between 529 plans and Coverdell ESAs.

- With both plans, your savings grow tax-free.

- Unlike 529 savings plans, Coverdell ESAs aren’t state-sponsored, so you can open one with your broker. This gives you more flexibility in the stocks, bonds, and mutual funds you want to invest in.

- While 529 plans have no annual contribution limits, Coverdell contributions are limited to $2,000 per year. What’s more, this is a limit per beneficiary, not per account. So even if you and your child’s grandparents open separate accounts, the combined annual contributions can’t exceed $2,000 for that child.

- Your annual income must be less than less than $110,000 (singles) or $220,000 (couples) to open a Coverdell ESA.

- You can only open a Coverdell ESA account for beneficiaries under 18 years old, and you can only make contributions until your beneficiary reaches age 18. A 529 plan has no age restrictions.

- Coverdell ESA contributions don’t qualify for state tax deductions, while many 529 plans do.

- You must use Coverdell funds by the time a student is age 30, or you’ll incur hefty taxes, fees, and penalties with withdrawals.

529 vs Roth IRA

A Roth IRA is a retirement savings account, but unlike many other retirement accounts, you can take out money on the portion you’ve contributed at any time without penalties or taxes. However, if you withdraw the investment earnings for qualified college expenses before age 59½, you’ll likely owe income taxes. Here are some key similarities and differences between 529 plans and Roth IRAs.

- With both plans, your savings grow tax-free.

- While there are no income restrictions to open a 529 plan, your annual income for the 2024 tax year must be under $161,000 (single) or $240,000 (married, filing jointly) to open a Roth IRA.

- You can only contribute up to $7,000 a year or $8,000 if you’re age 50 or older to a Roth IRA (for 2024), but there’s no annual cap on contributions to a 529 plan.

- There’s no state tax deduction for contributions to a Roth IRA, while many states give you deductions for 529 plan contributions.

- Money held in a Roth IRA isn’t counted for financial aid purposes, but withdrawals are counted as income — and that can affect your financial aid package. Qualified withdrawals from a 529 plan aren’t counted as income.

UTMA vs 529

A UTMA (Uniform Transfers to Minors Act) account is a custodial account that provides a way to transfer a variety of assets (money, real estate, patents, royalties, etc.) to a minor beneficiary. The gift-giver or an appointed custodian manages the minor’s account until the latter is of age (18 or 21 depending on the state). Here are some key similarities and differences between 529 plans and UTMAs.

- Tax benefits are generally more favorable with a 529 plan. With a UTMA account, the first $1,100 of unearned income (dividends, capital gains, and interest on your contributions) is tax-exempt. Annual unearned income between $1,100 and $2,200 is taxed at the child’s tax rate, and unearned income over $2,200 is taxed at the parent’s tax rate.

- UTMA accounts have no total maximum contribution limits, while most states cap the total in a 529 account.

- You’re not limited to qualified withdrawals with a UTMA account.

- UTMA accounts could make it harder for a student to qualify for need-based financial aid. While 529 plan assets are counted as the account owner’s assets on the FAFSA (Free Application for Federal Student Aid) form, UTMA account assets are counted as the beneficiary’s assets. It’s harder for a child to qualify when the assets are theirs.

- Ownership of a UTMA account transfers to the beneficiary when they turn either 18 or 21. With 529 plans, account holders can retain ownership no matter the age of the beneficiary.

Do You Need Financial Planning Advice For Retirement?

A huge plus with the new 529 plan rules is that you can roll over unused savings into a Roth IRA account. But if you don’t yet have a plan for retirement savings, that’s another major financial area you should set up as soon as possible. Check out my guide on the best retirement plans you’ll want to consider to give you the maximum savings goals. Also, be sure to read my reviews of the best stock and investment advice websites if you want to invest as wisely as possbile.

Why Trust Safe Smart Living?

Sally has years of experience in financial and estate planning communications for various organizations and foundations. She also works with a team of experts at Safe Smart Living, who are diligent in researching the ideal ways to plan for your financial future. Our team is committed to sharing our extensive knowledge with you, our readers, to help you secure your finances now and far beyond.