Pension Planning With Empower Retirement: My Experience

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Retirement planning tools are a great way to help you save and plan for the future. No matter what your income or career path is, having a solid plan for retirement not only offers financial security but peace of mind too, and using a free or paid-for online tool can help with just that.

Retirement calculators have been available online for years and have helped people across the globe crunch the numbers when it comes to retirement planning. These days, personal finance software such as Empower offers comprehensive free tools to give you a holistic view of your finances so you can see exactly how much to put aside for the future.

I signed up for an Empower Retirement account and thoroughly tested the service to see what it has to offer as one of the most popular online retirement tools on the market. Oh, and in case you were wondering, it’s never too early to start saving for your retirement!

Product Name: Empower Retirement

Product Description: Empower's pension planning tools help set budgets and saving plans for retirement.

Summary

Empower’s pension planning tools are robust and user-friendly. Through the personalized dashboard, you can manage your savings and see if you’re on track for retirement.

Overall Score

-

Customer Service

-

Features And Tools

-

Ease Of Use

-

Overall Value

Pros

- Easy to link pension accounts

- Available via desktop and App

- Fee analyzer to help eliminate unnecessary annual fees

- Personal dashboard with net worth and budget tracker

Cons

- Higher fees for high-earning members

- Requires a separate App to your main Empower account

6 Retirement Statistics You Won’t Believe

Before I take a look at Empower’s key features, let’s take a quick look at some retirement statistics from the Transamerica Center For Retirement Studies.

- The median retirement savings across all workers is $93,000

- 48% of workers believe they do not make enough money to save for retirement

- 43% of workers do not use retirement calculators or tools to identify how much they need to save for their future

- 22% of Americans have less than $5,000 saved for retirement, and 15% have no savings at all

- 70% of millennials are stressed about saving for retirement

- 57% of retired workers rely on social security income which in 2020 was an average of $1,544 per month

Introducing Empower

Empower personal finance software is a one-stop shop for all of your finances, investments, savings, pensions, and more. By linking various accounts to Empower’s platform, you can see your financial overview in a personalized dashboard and utilize Empower’s free tools to help you save and retain money.

If you require some assistance with family budgeting, savings, or investments, as I do, then Empower can be a useful platform for you. However, where Empower really excels is in the pension planning department, and its free tools have helped millions of US workers and retirees maximize their retirement funds and save even more than expected.

3 Key Features Of Empower’s Pension Tool

In my Empower Retirement testing, I came across three primary features: a personalized dashboard, savings planner, and retirement fee analyzer. I review these in-depth below.

Personalized Dashboard

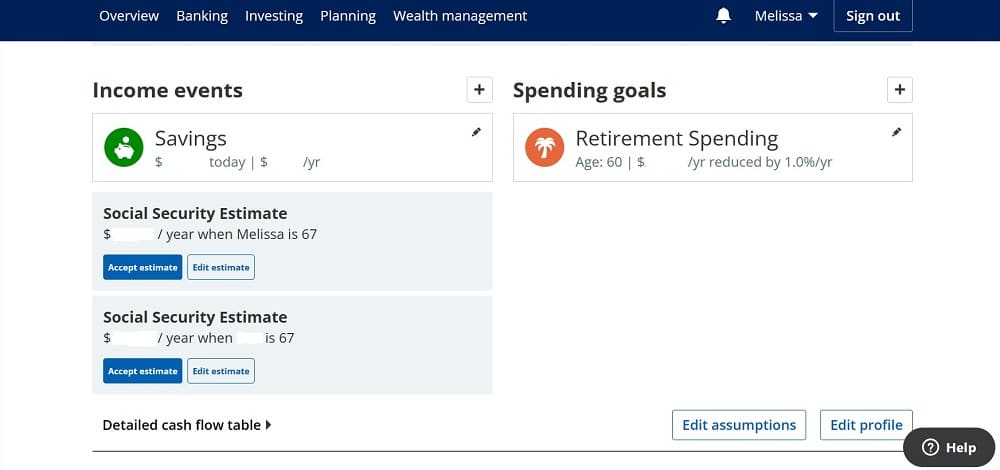

In the ‘planning’ section of your personalized dashboard, you can access your retirement planner page. Here you can see your projected portfolio value, your social security estimates for you and your spouse, and a detailed cash-flow table. This plan has been automated from a few personal details you enter when registering for the retirement tool. Not only does it lay out your finances clearly and concisely, but it also suggests where improvements can be made and where you need to make adjustments to achieve your goals. I found this self-explanatory dashboard to be easy to use, and liked how my finances were organized into sections.

Savings Planner

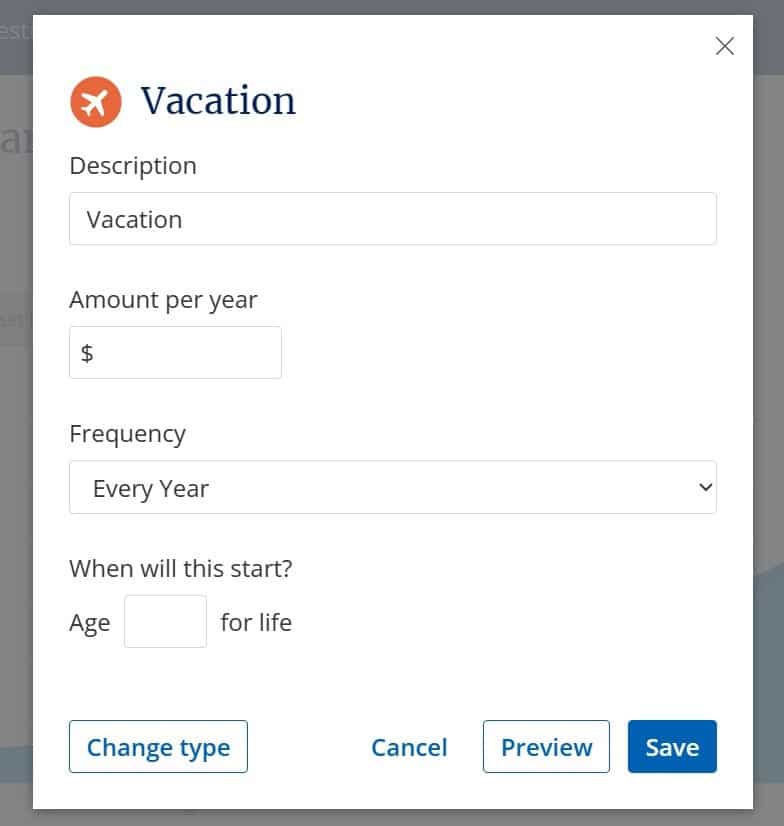

This data-driven feature allows you to link your investments and savings accounts to your retirement plan to see if you are saving enough to achieve your retirement goals. It can show you how much you have saved during the year, and If you go off track, this intuitive tool will make helpful suggestions in adjusting your plan. Not only that, you can add other spending goals such as vacation savings, car payments, and college funds in addition to your retirement funds, and Empower will calculate how much to save and where. In my experience, the vacation-saving tool has been particularly useful when planning for my annual vacation.

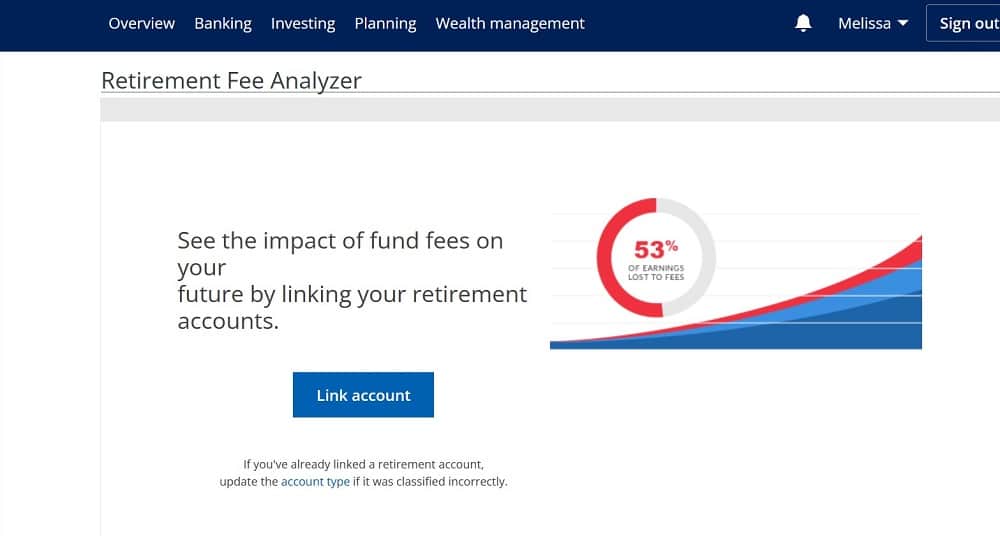

Retirement Fee Analyzer

This can be a valuable tool if you are a little loose in keeping track of expense ratios, annual fees, and more on your investments. The retirement fee analyzer can uncover those hidden costs and presents your funds, annual fees, and percentage of earnings lost to fees in an easy-to-read chart. It could save you thousands and give a boost to your pension fund. All you need to do is link your accounts and Empower will do the rest.

Setting Up And Using Empower’s Pension Tool

Here is a short video on how to set up your retirement account and how it can help organize your finances.

Empower – What’s The Verdict?

In my experience, Empower Retirement has been an easy-to-use tool for analyzing my finances and giving me a more in-depth view of what my retirement might look like. It has helped uncover unnecessary hidden fees and expenses and suggested an affordable amount to save each month for my retirement fund. I’m also confident that if my circumstances change (move jobs, purchase property, save for the kids’ college funds), Empower will re-calculate and suggest adjustments to my finances accordingly. I do not need to be a math whizz to secure my future finances.

Compared to others on the market, Empower’s budgeting tool has a little less to offer in terms of setting specific budgets and categories, but if you’re primarily using it as a pension planning tool, then this will not affect you. Also, if you have more than $100,000 in assets, that’s when the fees kick in, which can be a little higher than other paid-for finance software. Overall it is a robust tool and deserves its reputation as one of the best on the market.

Improve Your Personal Finances

Personal finance software can offer more than just pension and retirement planning. If you want to set budgets, track your investments, and more, then take a look at our comparison piece Best Personal Finance Software For 2023.

Are you saving for retirement? Have any online services or apps you find helpful? Let us know in the comments!