My Review Of Empower Personal Finance Software

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Managing your personal finances can seem like an overwhelming task, with many of us losing track of our monthly spending. Tracking bank accounts, savings accounts, pensions, and investment portfolios can be problematic when you have to log into various banking apps and websites. The good news is you can now access all of your financial information in one place at a fraction of the cost of a financial advisor via personal finance software.

There are many options when it comes to software for your personal finances, but depending on what you need will determine which one you choose. However, there are options for the ‘all-round’ customer who requires a solution for everyday budgeting, savings, and investment portfolios. Empower is a great place to begin if you are starting out on your personal finance journey or are an experienced investor. Below I take a look at what Empower has to offer and whether it’s the right tool for you and your financial security.

Product Name: Empower

Product Description: Empower personal finance software helps users set monthly budgets, manage investment portfolios and plan for retirement.

Summary

Empower’s personal finance software is easy to use, with some foolproof free tools to help manage your finances. The fees for high-earning investors are a little higher than its competitors, but you get what you pay for with this trusted and well-established brand.

Overall Score

-

Customer Service

-

Features And Tools

-

Ease Of Use

-

Overall Value

Pros

- Available for desktop and via an App

- Quick and easy to link accounts

- Free tools to help manage everyday finances

- Comprehensive pension planner

- Advice on investments and real-time performance reviews

Cons

- Fees for high-earning investors is higher than competitors

- Customer service is limited for non-paying members

- Budget planner does not let you create your own categories

Consumer Reviews

This is the aggregate score of reader reviews we’ve received. Have a good or bad experience with Empower? Feel free to leave your own review in the comments. Please note that only ratings with valid review content will be published and counted.

About Empower

Empower is a well-established brand dating back over 100 years. Starting out as a life assurance company and swiftly moving onto pension plans, Empower now offers robust tools for online money management and financial advice to young investors on Tik Tok.

Empower, in its own words, is “a financial services company on a mission to empower financial freedom for all.” As well as being a big-hitter in the retirement planning market, Empower has embraced the everyday financial needs of the American public and offers many valuable tools to help you take control of your finances. Here I take a look at the top tools Empower has to offer, the pros and cons, and provide an overview of its key features.

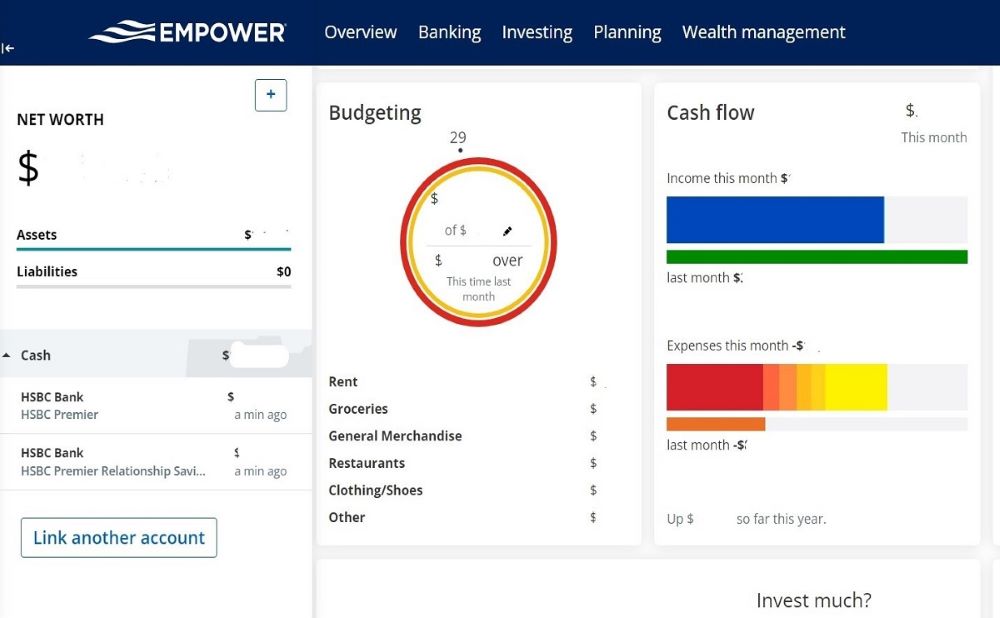

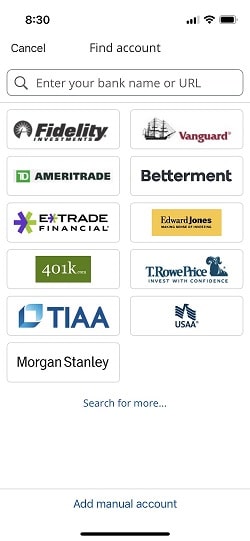

Sign Up And Start Saving

Signing up for an Empower account was quick and easy in my experience. Follow the prompts to link your bank accounts, credit cards, and investments, and you’re good to go. Once you have set up an account, you can start using the free personalized dashboard where you can see your net worth, spending, and your portfolios, and investments (available on desktop or via the App).

7 Key Features

Empower specializes in two things: free financial management tools with a comprehensive robo-advisory platform, and for high-earning investors and private clients, Empower offers additional access to real-life advisors to help with your investments and savings. Here are the main features:

- Budgeting platform – access to a personalized dashboard where you can set monthly budgets

- Net worth tracking – track your net worth over a period of time via visual graphs and charts

- Cash flow reporting – spending is separated into categories such as groceries, health care, and entertainment, so you can see exactly where your money goes

- Bill payments – in the banking section, you can access all of your bills and get alerts when bills are due to be paid

- Retirement planner – the retirement tool helps you stay on track when saving for the future

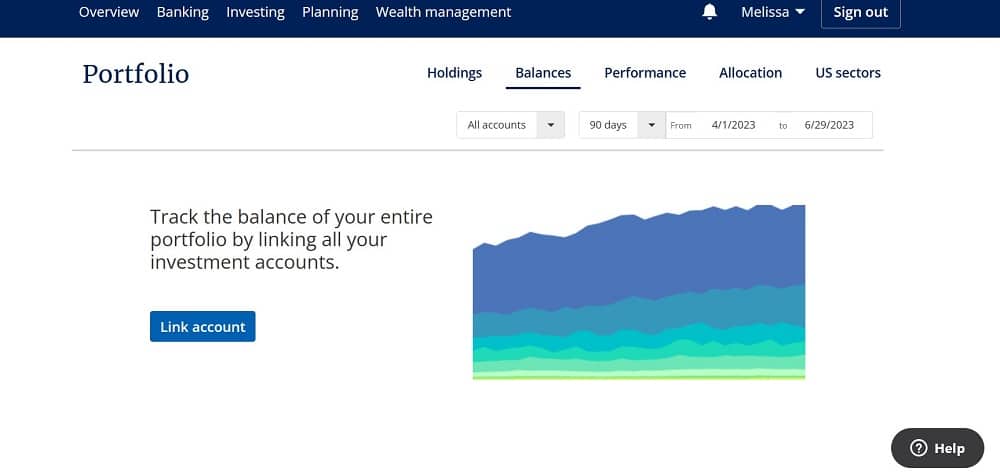

- Investment planning – view your investment portfolio and track performance over a certain period of time

- Wealth management – If you have over $100,000, you can access Empower’s robo-advisory wealth management service with access to live advisors who can offer advice on your investments

Who Is Empower For?

Most people with an income could benefit from using Empower and the key features it has to offer. Both finance newbies and high-earning investors will find this software useful. We are not taught money management at school, so few of us have the skills to budget effectively or know how to save for retirement. Empower’s easy-to-use tools can change how you manage your money and help reduce spending. If you are trying to get your finances in order and save for retirement, then Empower is for you.

Where Empower really excels is with its comprehensive Investing and wealth management tools. High-earning investors with over $100,000 in assets and private clients gain access to Empower’s advisory service, where live financial advisors are available for any questions you have, and help you set up investment plans and tax-efficient portfolios. Some consider this to be an invaluable service when they need to save for their kids’ college funds, retirement plans, and more. There are fees at a percentage of how much you invest, but these are considerably less than face-to-face financial advisors.

Empower’s Fees

Most of the tracking tools are free, but once you hit $100k in assets and want access to the financial advisors, the fee structure is as follows:

- Investment Services – $100,000-$200,000 0.89% (access to one advisor)

- Wealth Management – $200,000-$1 million (access to two advisors)

- Private Clients – $1 million and above 0.49% (access to Empower’s Investment Committee, two advisors, and retirement planning assistance)

Money On The Move – Empower’s Mobile App

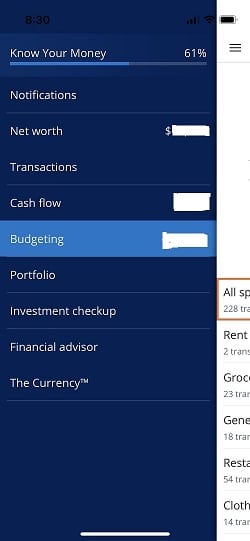

Empower’s free mobile App is available for both iOS (which is what I use) and Android. Its recent update means that the App is now more user-friendly and can compete with other top-rated personal finance Apps. The App makes it easy to track budgets and see what you’re spending when you’re out and about. I found that quick access to my spending records in certain categories, such as groceries and restaurants, would help me cut back or rethink those extra purchases when out in the real world.

Most of the features found on the desktop version are available on the App. Budgets, cash flow charts, and investment portfolio trackers can be found at the touch of a button on your smartphone. You can also set up your account via the app and easily link your bank accounts and investments. However, it seems that pension information isn’t accessible via the App and is only available via desktop.

What I Like (And Don’t Like) About Empower

| Pros | Cons |

|---|---|

| Integrates all investments into one convenient, personalized dashboard | Cannot create your own spending categories |

| Budget tracking tool to keep on top of your spending | Competitors have better budgeting tools |

| A highly-rated retirement planning tool | Higher fees for wealth management services than competitors |

| No software to install | Wealth management tools are only accessible to high-earners/investors |

| No joining fees | |

| comprehensive reporting features | |

| Extensive wealth management with access to real-life financial advisors | |

| Available for desktop and app |

Final Thoughts On Empower

I found Empower to be extremely user-friendly, with a wealth of financial tools available for all situations. Budgeting, savings, investments, and retirement planning tools are all important when striving for the “financial freedom” that Empower promises. Its strengths certainly lie in its wealth management services.

Still, The Federal Reserve’s figures show that the average median assets among US households are $25,000, so Empower’s wealth management tool is only available to a small group of people. Also, the fees are a little higher than its competitors.

In conclusion, Empower is a viable option for most consumers wishing to get their finances in order, with high-earning investors and pension-savvy customers benefitting the most from what Empower has to offer.

Personal Finance For You

Are you in search of the perfect personal finance software to meet your money management needs? Read our personal finance comparison or check out our comparison piece Empower (formerly Personal Capital) Vs Mint.

Have your investments improved with personal finance software? Let us know in the comments!