Best Stock Research Websites: Motley Fool vs Zacks vs Morningstar vs Seeking Alpha vs The Street & More

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Investing your money wisely takes a great deal of ongoing research. And with hundreds of financial websites at your fingertips, where do you start? If you’re a serious investor, free advice only goes so far. We’ve chosen some of the best investment advice websites that won’t cost you an arm and a leg, so you can instead focus on investing your hard-earned dollars.

Jeff Butler is our financial guru, holding an undergraduate degree in Finance from Malone University. He has a diverse background in small business ownership, accounting, and property management. With his expertise in personal finance, Jeff consults on and reviews our investing and financial content, including this article.

When The Market Panics — Take A Breath

One of the things we advocate here at Safe Smart Living is a balanced investment approach. That especially applies to panic selling during adverse market events, and the coronavirus (COVID-19) pandemic was no exception.

What should you do? The key to successful investing is to have a consistent strategy. In our case, we advocate investing based on company fundamentals and not looking at “sell points” outside of those fundamentals (e.g., making trades based on charts). In other words, just keep an eye on your portfolio as you would always do, and if a company gets too “rich” in terms of its valuation, consider trimming some of your holdings.

Ironically, panic selling does the opposite of actually creating selling opportunities if you follow this model. It creates opportunities instead since company valuations get more attractive during overselling. Think about how much less stress this approach involves — instead of worrying about your stocks going down, you spot opportunities, e.g., companies on sale, instead.

If there’s one thing we’d like you to take home from all this, it’s this:

Why You Should Not Sell In A Panic

Going back to 1930, Bank of America found that if an investor sat out the S&P 500’s best 10 days per decade, returns would have been significantly lower (just 91%) than those who held and waited it out (14,962%)!

Why is that? Because the best days generally follow the worst days. And when you look at historical attempts to “time” these wild swings during panic selling, those who invested in timing vs company fundamentals typically lose more over the long haul.

Best Stock Research Websites

We’ve chosen some of the best sites for you to do research and analysis, get commodities tips and news, tools for tracking your investments, and much more.

| Beginners | |

| Advanced | |

| Mutual Funds & ETFs | |

| Trading |  Visit Website | Read Review |

For Beginners: The Motley Fool Review

The Motley Fool is an excellent resource for people who want to develop a well-rounded stock portfolio but not spend a ton of time getting down and dirty with advanced analytics. Its website offers a lot of free information, including trending news, investing articles, a stock tracker, assistance finding a broker, retirement resources, podcasts, and much more.

Track Your Own Stock Portfolio vs The Pros, Free

It’s free to join their highly active CAPS community, where you can get advice on the best stocks to buy (and when to buy) — and which stocks to avoid. You can track your own stock portfolio, make trades, and compete with the market indices and pro investors. Also noteworthy are The Motley Fool’s preferred stock tracking and comparison tools.

Its flagship service, The Motley Fool Stock Advisor, is a premium subscription service that helps investors choose long-term growth stocks. This service has a good track record and is a more affordable option than many other premium investment services you’ll find online. For $199 a year, you’ll get:

- Two new stock picks per month.

- Weekly advice about the best 10 timely buys for hot-stock commodities.

- Starter stock recommendations for newbies.

- 4 to 8 email newsletters per month with new recommendations, the latest stock news, and their expert analysis.

- Favorites and Scorecard features, so you can keep track of stocks you’re keeping an eye on.

- Detailed tables, charts, and reports on the latest stock trends, specific industries to focus on, company information, and more.

- Highly active discussion boards, which include novice and seasoned investors who share a wide variety of advice.

The Motley Fool also offers Rule Breakers (for high-growth stock picks), Rule Your Retirement, and many other subscription services.

The Motley Fool Stock Homepage

Pricing

The Motley Fool offers a 30-day money-back guarantee for all of its subscriptions.

- Stock Advisor: $199/year ($99 for the first year)

- Rule Your Retirement: $149/year ($99 for the first year)

- Rule Breakers: $299/year ($99 for the first year)

Discounts And Promo Codes

For a limited time, our readers get the first year of Stock Advisor for $89.

Read Our Full Review of Motley Fool’s Stock Advisor

For Advanced Investors: Seeking Alpha Review

Seeking Alpha offers a wealth of crowdsourced research content written by investment management experts. Most of the content is geared toward an intermediate to advanced audience and includes an in-depth analysis of individual holdings. All of their writers are required to disclose information about their holdings or affiliations with companies.

This site is also an invaluable place to conduct company research. It publishes management conference call transcripts for many companies — these transcripts can give you insight into each company’s prior quarterly performance and management’s outlook for future performance.

Seeking Alpha offers both free and paid membership content. The free version offers the latest stock news and analysis and portfolio management tools, but access to the most in-depth articles and analysis is limited.

Seeking Alpha Premium provides greater access to new and archived articles and news, as well as individual security recommendations, alerts, charts, and comparison tools.

Seeking Alpha Pro is advertisement-free and tailored for professional-level investors. It provides access to exclusive investing ideas, charts, research tools, the ability to create on-demand ticker research for specific securities, and much more.

Seeking Alpha Chart

| Pros | Cons |

|---|---|

|

|

Pricing

Seeking Alpha offers a 14-day free trial for both of its paid subscriptions (credit card required).

- Basic: free

- Premium: $239.88/year or $29.99/month

- Pro: $2,399.88/year or $299.99/month

- View all subscription options

Read Our Full Review of Seeking Alpha

For Mutual Funds & ETFs: Morningstar Review

Morningstar is widely considered one of the best resources for fundamental investment research and stock data — and arguably the leading source for mutual fund and exchange-traded fund (ETF) data. Its website presents information in easy-to-digest graphics.

Its basic service is free and includes current and historical data, including financial statements and price data for individual companies, as well as a wide range of other performance statistics.

Morningstar’s premium service gives you access to in-depth analysis and widely respected ratings from over 150 Morningstar analysts and the ability to screen stocks, mutual funds, and EFTs based on crucial data points. This makes it easy to find their top investment ideas based on your individual investing goals.

The premium service also includes a comprehensive portfolio evaluation tool that shows how diversified your mutual fund portfolio is and gives you advice on improving your asset allocation.

Personal Experience

One of our team members has used Morningstar since Q1 2018, and this is their personal experience.

I used to do all of my retirement planning myself but decided to hire a financial advisor to help me prepare for my future and make sure I had all my bases covered. We decided together that Morningstar would be a good portfolio manager to use for one of my investment accounts, and I’ve been pleased with it for the most part.

The portal is fairly outdated in appearance, but it tracks my investments correctly, which is more important to me. I like the quick views I can get of my accounts’ overall performance and how the market is performing as well.

My favorite Morningstar feature is seeing my general account overview in an easy-to-read format. It’s easy to see my purchases, withdrawals, shares held, and other quick stats for my portfolio. The page is uncluttered, a plus for those who prefer a distraction-free layout.

Morningstar Screenshot

| Pros | Cons |

|---|---|

|

|

A word of caution: While Morningstar offers a 14-day free trial for its premium subscription, we found several complaints from consumers who said it’s extremely difficult to cancel.

Pricing

- $29.95 monthly

- $199 for 1 year

- $349 for 2 years

- $449 for 3 years

- Free trial and subscription options

Read Our Full Review of Morningstar Premium

For Trading: Zacks Review

Zacks Investment Research provides independent research to give investors advice about buying stocks, mutual funds, and ETFs, with a strong emphasis on gaining a trading advantage. Their free services include stock news, research articles written by quantitative analysts, and stock and mutual fund screeners. But if you’re a serious trader, you may want to opt for their premium membership to get the ideal buying and trading advice.

Zacks Premium has a proprietary mutual fund ranking system that helps you in your decision to buy or sell. They cover nearly 19,000 mutual funds, which they rate on a one-to-five scale. A rating of one, for example, is a “strong-buy” recommendation, and a rating of five is a “strong-sell” recommendation.

Zacks Premium also includes:

- Zacks #1 Rank list — the top 5% of stocks with the most potential for outperforming the market (updated daily)

- Premium Stock Screens that filter by value, growth, momentum, income, and more

- Focus List — a portfolio of 50 longer-term stocks to consider

- Earnings ESP (Expected Surprise Prediction) Filter — find stocks that Zacks analysts think will beat the Wall Street expectations (good for short-term traders)

- Extensive equity research reports

Zacks also has two higher-tier subscriptions. Their Investor Collection (meant for long-term investors) comes with everything in Premium plus real-time buy and sell signals and their Stocks Under $10 strategy. Zacks Ultimate includes access to everything plus exclusive stock picks and analysis.

Zacks Screenshot

| Pros | Cons |

|---|---|

|

|

Pricing

Zacks Premium has a 30-day free trial. Investor Collection and Ultimate have a 30-day trial for $1.

- Premium: $249/year

- Investor Collection: $495/year or $59 monthly

- Ultimate: $2,995/year or $299 monthly

- View all subscription options

Read Our Full Review of Zacks Investment Research

What Are My Other Options?

Although these sites didn’t make our top picks, they’re definitely worth checking out.

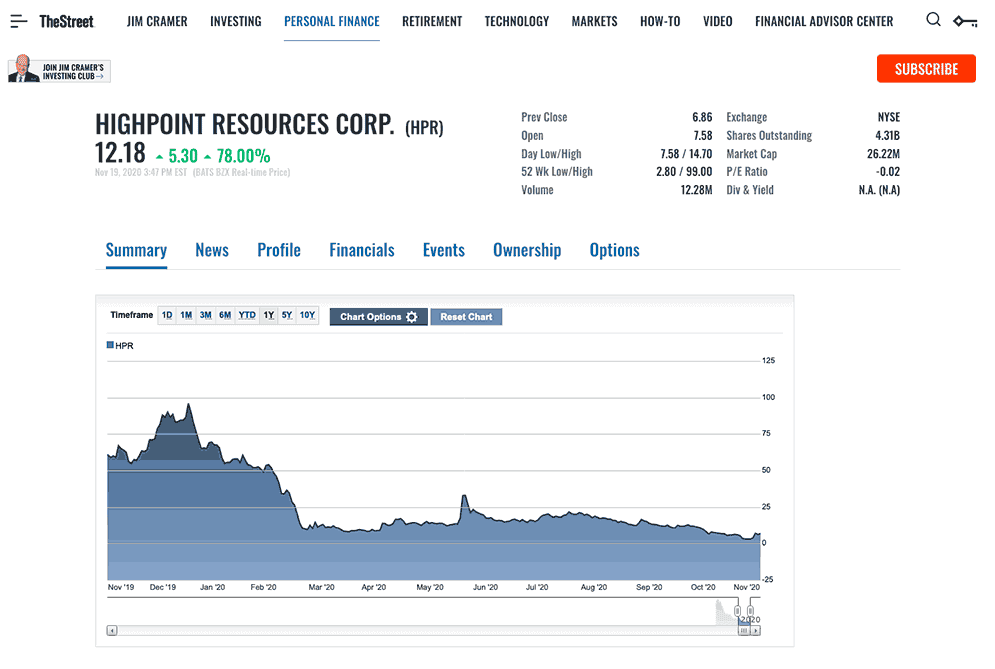

The Street Review

If you’re into investing, you’re likely familiar with the co-founder and owner of The Street, Jim Cramer of CNBC’s Mad Money. Cramer and his team offer a wide variety of free content and paid subscription options.

The Street is a great site for newbies to learn the basics of investing as well as professional traders to get the most up-to-date investing news, all for free. But we think this website falls a bit short compared to similar sites like The Motley Fool and Morningstar for basic investing features (like a portfolio manager) and other offerings.

However, if you’re a big Jim Cramer follower, The Street has some interesting options. The Street’s most popular premium subscription is Action Alerts PLUS, a stock picker and investing newsletter run by Cramer and his staff at The Street. It’s most similar to The Motley Fool’s Stock Advisor subscription, although at a much heftier annual price. It includes:

- Investing tips and education from Jim Cramer

- Exclusive access to the members-only monthly conference calls

- Real-time investment alerts every time Jim Cramer and his AAP team buy or sell

- 24/7 access to Jim Cramer’s portfolio

The Street also has seven other subscription options for various interests, including stock, bond, ETF, etc. But we’re not confident that The Street gives you a better bang for your buck with these subscriptions compared to what you can find with our top picks in this article.

The Street Screenshot

| Pros | Cons |

|---|---|

|

|

Pricing

The Street offers a 14-day free trial for all of their subscription plans.

- Action Alerts PLUS: $299.95/ year

- Stocks Under $10: $199.95/year

- Trifecta Stocks: $299.95/year

- Top Stocks: $499.95/year

- The Street Quant Ratings: $49.95/year

- Real Money: $149.95/year

- Real Money Pro: $799.95/year

- View all options

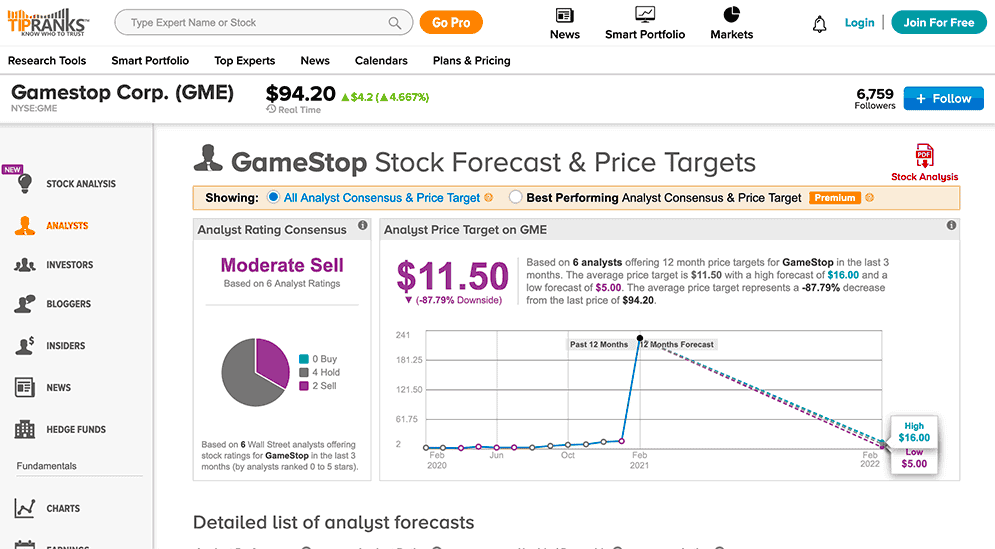

TipRanks Review

Unlike the other sites we review here, TipRanks doesn’t have any original data and analysis; rather, it compiles public stock recommendations from thousands of financial analysts and bloggers and ranks them based on their accuracy and performance. It also collects valuable insider trading information.

TipRanks has a solid reputation, an easy-to-maneuver interface, and many simple but robust ways to search through experts’ analysis and top stock picks. In short, it can save you a ton of time scouring through multiple sources around the web — you can find what the experts are recommending all in one place.

You can search through the 25 best-performing analysts in each sector (Wall Street analysts, financial bloggers, corporate insiders, hedge fund managers, and more), find all analysts’ strong buy and sell ratings, filter through their stock picks by market cap and sector, and much more. The site also has a great stock screener and portfolio tool.

While TipRanks has a free plan, it’s extremely limited, so you’ll need to pay for an annual subscription, which is on the pricey side, to access most of its content. But if time is one of your most precious commodities, TipRanks may be worth every penny.

TipRanks Screenshot

| Pros | Cons |

|---|---|

|

|

Pricing

TipRanks offers a basic membership for free, but the content is extremely limited. Its two paid subscriptions both have a 30-day money-back guarantee, and you must sign up for an annual membership (no monthly subscriptions are available). View all options.

Premium

- $359.40 per year

- Access to most of the site’s content and tools

- Follow up to five experts with email notifications

- Create a single portfolio

Ultimate

- $599.40 per year

- Full access, including the ability to follow stocks with significant insider trading activity (not offered in Premium)

- Follow unlimited experts with email notifications

- Create and manage multiple portfolios

Read Our Full Review Of TipRanks

Best Investment Websites For News & Advice

Be sure to check out these sites for the latest investing news and advice.

Barron’s

Barron’s digital and print magazine has been widely respected for years for its in-depth coverage of U.S. financial information, market developments, relevant statistics, stock advice, and much more.

Barrons.com includes its own articles and articles from other top-notch investment sites like The Wall Street Journal, MarketWatch, and Dow Jones Newswires. The introductory rate is $1 for four weeks. They also offer $14.99/month if you sign up for a year of subscriptions or $8.34/month if you sign up for two years.

Bloomberg

Bloomberg is a well-known site that offers extensive business, financial, and stock market news. The site has a lot of information about stock futures, sector performance, an economic calendar, and a Watchlist, where you can build a portfolio to track your favorite companies and indexes and follow related breaking news.

Bloomberg gives you free access to 10 articles per month. To see all content, they have a couple of subscription options starting at $34.99 per month, but they often have special introductory discounts.

Yahoo! Finance

Yahoo! Finance should be one of your go-to sites for its industry and sector news, as well as company information. The free version has a wealth of financial information, analyst estimates, message boards, and much more. It will cost you $34.99/month or $349.99/year to get advanced analytics and detailed company profiles, but you can try out their premium membership with a 14-day free trial.

Investing Tips For Beginners

See these key investing tips from life and business strategist Tony Robbins.

Investing In Your Retirement

While investing in the stock market is a fun and rewarding financial venture, you want to make sure you’re soundly invested in your retirement. Be sure to read our best retirement plans article, where we give you detailed information and tips about employer-sponsored retirement accounts, IRAs, and more.