IDShield Reviews: Is It Worth It? Customer Reviews, Vs LifeLock, & More

When you purchase through links on our site, we may earn a commission. Here’s how it works.

You try to open a new credit card only to discover that you’re declined because your credit isn’t worthy. What gives? Without your knowledge, someone has stolen your identity, taken credit out in your name, and ruined your credit record. Moving forward, how can you protect yourself? IDShield can help you dig yourself out of ID theft.

You try to open a new credit card only to discover that you’re declined because your credit isn’t worthy. What gives? Without your knowledge, someone has stolen your identity, taken credit out in your name, and ruined your credit record. Moving forward, how can you protect yourself? IDShield can help you dig yourself out of ID theft.

What is IDShield? IDShield, a product of LegalShield, is an identity theft protection service that monitors your online credit and personal information to protect you against identity thieves. And it’s the only ID theft service that uses licensed private investigators to work your case. Our IDShield review will give you all the info you need to see if this service is right for you.

IDShield

Pros

- Very affordable individual and family plans

- Offers a $1 million ID insurance

- Family plan protects up to 10 people

- Uses licensed private investigators

- Free LegalShield ID Shield app for iOS and Android

- Parent company, LegalShield, is A+ BBB rated

- 24/7 emergency support

Cons

- No free trial

- Doesn’t include internet security software

- Need to reconnect LinkedIn frequently

Key Features

- Provides consultation & resolution services with assistance from licensed private investigators

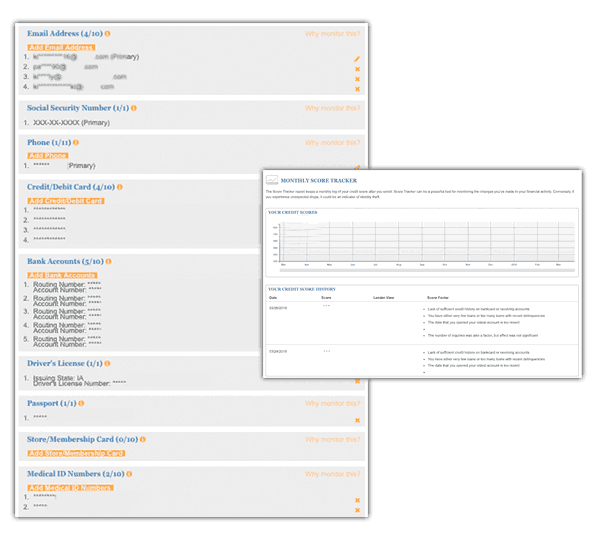

- Monitors personal information (Social Security number, driver’s license number, date of birth, full name, passport number, email addresses, phone numbers, medical ID numbers, and social media accounts)

- Social Security number fraud detection

- Monitors financial information (loans, leases, bank accounts, and credit cards)

- Monitors public and criminal records and change of address requests

- Free IDShield app and LegalShield identity theft app that send you fraud alerts on your smartphone and connect you directly to experts

- Free IDShield login password manager

Pricing

The only difference between the plans below (besides the cost) is the number of people covered. The individual plan covers one person; the family plan covers you, your spouse or domestic partner, and all dependents under 18 living with you; and the business plan covers up to 6 or 12 public IP addresses or URL’s. Our readers can take advantage of a 30-day free trial and a discount if paying annually.

- Individual Plan: $14.95/month (1 bureau); $19.95/month (3 bureaus)

- Family Plan: $29.95/month (1 bureau); $34.95/month (3 bureaus)

- Business Plan: $79.95/month (6 IP addresses or URL’s); $149/month (12 IP addresses or URL’s)

MLegalShield’s Consulting & Resolution Services

IDShield’s unique consulting and resolution services are arguably their best selling point. But in our research, we came across several questions about a Legal Shield scam (LegalShield is IDShield’s parent company). Are they legit? Yes! In fact, LegalShield has partnered with Kroll, a worldwide leader in risk mitigation and response solutions, to provide ID theft protection and resolution for nearly 20 years. The two organizations created IDShield to assist consumers in the growing risk of data breaches.

Consultation Services

IDShield provides members both regular and emergency access to licensed private investigators, who average seven years of experience from law enforcement, banking and collection backgrounds. These experts advise you on everything from how to identify scams to how to shop safely online. Reps are available during regular business hours from 7 a.m. to 7 p.m. ET Monday through Friday, but you also get emergency assistance 24/7/365 via a separate line.

Resolution Services

If you become an ID theft victim or if you find your identity compromised in any way, IDShield guarantees they’ll spend up to $1 million to fully restore your identity using their licensed private investigators and legal team. The benefit to you is that IDShield does all the hard work for you.

How does it work? You must first sign over limited power of attorney to IDShield’s investigative team. Their team will collaborate with financial institutions, credit bureaus, credit card companies, local and federal law enforcement, and other related organizations to clear your identity.

Customer Reviews

Positive Reviews

I love getting emails or logging into my account and seeing “Nothing to report” and not just knowing there have been no red flags in the previous month but it also reminds me that my personally identifiable information is being monitored on the dark web and the Internet. It provides huge peace of mind that if my identity is ever suspected to be compromised, there are experts who will research and fix everything. Without IDShield, I wouldn’t know where to begin in that situation. – Sheryl, ConsumerAffairs 6/18/2022

I can rest easily knowing that ID Shield is watching out for me. As a victim of identity theft, I am very cautious now, and I know they will always be there for me. – Tina, Trustpilot 5/19/2022

Complaints

IDShield and Kroll representatives seem like they’re reading from a script. I’ve used their service for more than 2 years. I’ve contacted the company at least 10 times and each interaction has been frustrating and disappointing. – Carolyn, ConsumerAffiars 4/12/2019

Everytime I try something it does not work. Just tried getting my credit reports and had issues with trying to get Equifax. Not even sure if my other 2 went through. Disappointed as I was hoping this would be easy. – Madge, Trustpilot 4/28/2022

What’s It Like To Use IDShield?

A member of Safe Smart Living, Kimberly, began protecting her identity with IDShield back in March 2018. Here is her experience.

I have tested and used other identity theft protection services through work and have tried free accounts following data breaches where my information may have been compromised. After these account trials ended, I knew I needed to sign up for a service on my own.

I chose IDShield because of its low price point, family coverage and great customer reviews. My husband currently has his own identity theft protection through another company, but he will join my plan once his ends. We are also expecting our first child in August 2018 and will be adding him to our plan as well.

It is huge to have all three of us covered for less than $25 per month since most companies charge a great deal more. We know how important it is for all individuals (no matter the age) to have identity theft protection, so it was important to us to enroll as a family.

Although I haven’t been using IDShield for long, it has been an easy transition. Setting up my email addresses, Social Security number, phone number, credit/debit cards, bank accounts, driver’s license, passport, medical ID numbers and social media accounts was extremely simple.

I also like that it monitors my credit score, so I can see a history of it and the reasons why the score varies from time to time. Most of all, I love the peace of mind it provides. I’m familiar with identity theft due to my job, and with us welcoming our first child in August, I am not willing to risk their identity.

If I had to change one thing, it would be the look. Although everything is very user-friendly, it has a somewhat outdated design compared to other identity theft protection services I’ve used. However, for the price, there is no way I would change services to get a prettier interface.

I have already received a few notifications alerting me to potential identity threats. Most of them have involved an old email where the email and password are shared online. I have since changed the password, so hopefully, all is well. It brings me comfort knowing this was brought to my attention so I could address the threat before a potential hacker tried to use my login credentials.

Overall, I would recommend this service to anyone, but especially families. Being able to cover up to 10 people for less than $25 per month is extremely affordable considering other companies can charge that much for each person. Although I don’t intend on having 8 children, I realize that some families will benefit greatly from this feature.

IDShield Vs The Competition

These are the key differences between IDShield and other competitors.

IDShield Vs LifeLock

- IDShield offers a family plan for only $25.95 per month, you get coverage for two adults and up to 10 minors. There is no LifeLock family plan. You’re required to have separate accounts for adults, and you must pay $5.99 per month for each child for their LifeLock Junior package.

- IDShield’s app provides a quick connection to fraud specialists and they are licensed private investigators; LifeLock’s is not.

IDShield Vs IdentityForce

- IdentityForce has the industry’s largest scope of monitoring coverage.

- IDShield’s family plan is $25.95/mo, whereas IdentityForce doesn’t have a family plan (instead you pay $2.75/mo per child).

- IDShield’s fraud specialists are licensed private investigators, IdentityForce’s are not.

IDShield Vs Identity Guard

- IDShield’s Family Plan is cheaper than Identity Guard’s.

- Like IdentityForce and LifeLock, Identity Guard offers full recovery services, but without the benefit of IDShield’s licensed private investigators.

Five Easy Ways To Protect Your Identity

Check out this video by the Federal Trade Commission that gives you some basic tips on things you should be doing on a regular basis to protect your identity.

How Does ID Shield Compare To Alternatives?

IDShield is one of many identity theft protection services on the market. Be sure to see how they stack up against their competition in our comprehensive ID theft service comparison. And, if credit monitoring is important to you, see what services we’ve uncovered in our credit monitoring reviews.